Global Startups Research & Market Intelligence REPORT

Identify Partners Series

Immuno-oncology Startups

2020

Latest Report covering World’s Largest Number of Active Immuno-Oncology Drug Developers

RELEASED - DECEMBER 2019

Top 400

Immuno Oncology Startups

Provides Complete Landscape on Latest Immuno-Oncology Drug Development covering Emerging Technologies, Partnering and Funding Status among Startups

Immuno-Oncology Startups 2020 (First Edition)

Report Covers all Aspects of Immuno-Oncology Drug Development Intelligence

STARTUPS PROFILE * MOLECULES * INDICATIONS * TECHNOLOGIES * DEALS * FUNDING

largest coverage

providing intelligence at fingertips

Worldwide Extensive Coverage

Formed after 2010; with Market Valuation less then $500Mn USD

Largest Early Stage Developmental Pipeline Details

Covers exclusive I/O focused Deals, partnering with BIG Pharma, CROs etc.

Perfect B2B Solution

Unique first in class Intelligence Report

Provides Complete Landscape on Latest Immuno-Oncology Drug Development covering Emerging Technologies, Partnering and Funding Status in the Domain.

Also, Startups having proper funding, technologies and pipeline are only included.

No Acquired, Merged or Dormant Stage I/O Drug Developer is included.

Need of the Report

- From last few years maximum number of Startups are opting for Immuno-Oncology drug discovery challenge.

- Higher Collaboration to aid drug development process: Immuno-Oncology drug discovery is evolving and requires timely strong support and inputs across the channel.

- Well-funded, thus offers immense partnering opportunities, but lacks proper system to track emerging opportunities.

- Currently available resources cover only limited number of known companies that too developing late stage clinical molecules. But real challenge lies in timely identifying the startup, having potential of future shining star.

- Virtually no system to track, Startups outside U.S and China, which contributes to 30% of total established startups in I/O domain.

Instant Answers

Report is highly precise and designed keeping in mind to keep information intact, informative and self explanatory. Also, every piece of intelligence is cross validated.

Only facts, no guess work.

Huge Time Saver

330+ Pages present complete picture of individual company’s pipeline, deals, partnering, funding etc. and outline individual startup’s core strength and stand with respect to other startups.

Report documents all I/O focused news/deals of every startups since incorporation. Making it perfect tool for Decision Making and a big time saver too.

Active Drug Developers Only

Compares Oranges with Oranges.

Only Active I/O Drug Developing Startups, with no room to Diagnostic and Device companies; making data clear and impactful.

Value for Money

Most of the intelligence provider covers limited number of known companies, that too many of which have no links to the core title of the report. Also many renowned database too contains acquired/closed companies, thus driving final intelligence too tedious and time consuming exercise.

All our reports provides comprehensive intelligence, with largest active industry coverage and avoids investing money on other similar resources. Thus, saves lots of resources in terms of time and money, in identifying new partnering opportunities.

Designed by Industry Experts

Each year, we publish very small number of comprehensive reports and are experts in identifying and tracking startups. We maintain our own database and track’s every individual company.

From last 10 years, our team exclusively providing marketing intelligence in field of Oncology and Neurology Drug Development.

334 pages - full of insights

intelligence supercharged

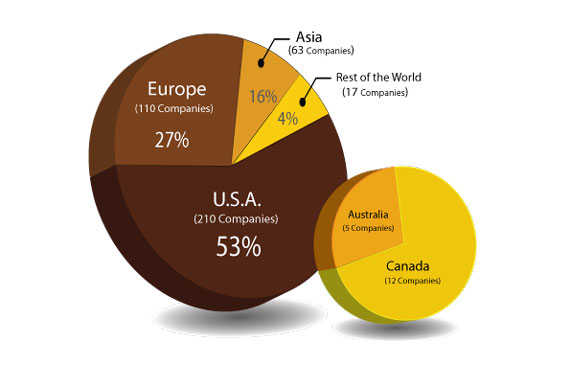

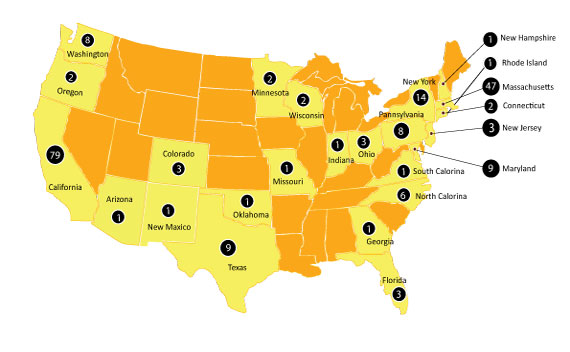

Report for the first time identifies and profiles Top 400 Active Immuno-Oncology Startup companies from 24 different countries worldwide, developing 581 cancer targeting drugs; established between 2010 – September 2019.

To bring this massive report on table, Industry experts for the first time analyzed nearly 650 I/O Startups established during this period and filter out, key 400 active drug developers, based on their technology, management capabilities and current funding status to further scaleup their drug discovery processes.

This highly precise 334 pages report is designed to keep information intact, informative and self-explanatory. Thus, Immuno-Oncology Startups 2020, will help organizations working on cancer research, to supercharge with lots of new decision-making information and jumpstart current partnering/marketing efforts.

Need of the Report:

- Filter Authentic Data: Last few years added maximum number of new-cos in Immuno-Oncology drug discovery this added an urgent need to filter serious from non-serious one.

- Higher Collaboration to aid drug development process: Immuno-Oncology drug discovery is evolving and requires timely strong support and inputs across the channel.

- Well-funded, thus offers immense partnering opportunities, but lacks proper system to track emerging opportunities.

- Currently available resources cover only limited number of known companies that too developing late stage clinical molecules. But real challenge lies in timely identifying the future shining star.

- Virtually no system to track, Startups outside U.S and China, which contributes to 30% of total established startups in I/O domain.

Key Highlights of the Report:

– Startups Focused – Highly innovative, first of its type, which includes only Immuno-Oncology Startups Developing – Immune Checkpoint Modulators; Cellular Immunotherapies; Oncolytic Viruses based Therapeutics, Peptide Vaccines, Bispecific T Cell Engagers and Monoclonal Antibodies targeting cancer.

– Technology / Drug Pipeline – Details on Individual Startup’s proprietary Technologies with its Active Cancer Pipeline and University / Institutes Collaborations.

– Provides details on 581 early stage noble I/O molecules available for bio-partnering, with targets and mechanism of action.

– Strategic Moves & Advantages- Quickly Identify the key strategic moves a startup is taking to be more innovative, also identify its strategic advantages, that will boost its growth going forward.

– Venture Funding / Partnering – Monitor Individual Startup’s Various Funding Rounds (Private / Govt. ). Its current Partnering Status with CROs / Research Institutes / Big Pharma.

– Report covers over 700+ I/O exclusive partnering deals and funding round details of 400 companies, since their incorporation

– Provides several Intelligence pointers like – Top 20 I/O Drug Developers capable of changing oncology research going forward. Big Pharma investments and partnering with I/O startups, along-with Key Venture Investors and their portfolio companies in this domain.

Reasons to Buy

- Largest, single source collection of early stage I/O pipeline; which otherwise is very difficult to identify and map for emerging companies.

- Report provides you with the holistic view on latest technology advances in I/O and emerging clinical trial combinations in I/O Space.

- All Top 400 companies are profiled in form of mini-reports and includes, all their I/O focused major business deals, funding, proprietary technologies and drug updates, since incorporation.

- Report is Gold mine in organizing your sales and marketing efforts by identifying new leads and better positioning existing startups based on latest updated knowledge on their upcoming projects and current funding status. It also provides LinkedIn & e-mail IDs of key decision makers (CXOs) of all startups; making things further smoother.

- Every piece of intelligence is cross validated. Startups having proper funding, technologies and pipeline are only included. No Acquired, Merged or Dormant Stage I/O Drug Developer is included.

- Designed by Industry Experts, who exclusively tracks bio-startups and publish exclusively in this domain.

Executive Summary

List of Figures

List of Tables

List of Top 400 Immuno-Oncology Startups

Section A : Immuno-Oncology Startups 2020 – Top 400 Active Drug Developers Summary

Infographics – Quantitative Estimation of Immuno-Oncology Startups present in U.S.A vs. Europe vs. Asia vs.Canada vs. Rest of the World. (Established between Jan 2010 to Sep 2019).

Infographics – Distribution of Top 400 Immuno Oncology Startups, on the basis of Year of Establishment. (To explore the emergence of Cancer Drug Discovery And Development).

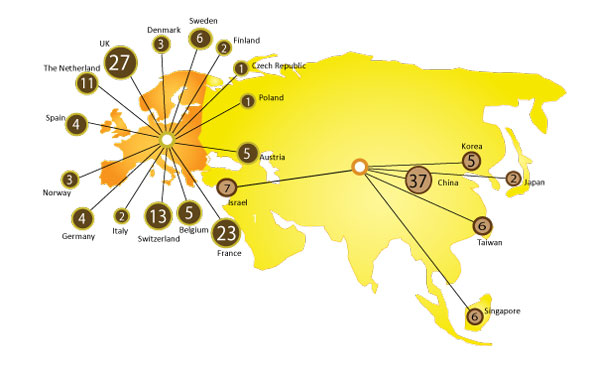

Infographics – Country-wise Distribution of Immuno-Oncology Startups having Active Cancer Drug Development Program in Europe & Asia Region. (To identify best and emerging countries, for promoting cancer startups).

Infographics – State-wise Distribution of Immuno-Oncology Startups having Active Cancer Drug Development Program in U.S.A. (To explore the Top cancer startups supporting States in United States).

Top 15 Innovative Game Changer Immuno-Oncology Startups. (Capable of changing tomorrow’s Cancer Drug Discovery & Development).

Immuno-Oncology Startups Developing – Immune Checkpoint Modulators.

Developing drugs, which blocks certain proteins (PD-1/PD-L1 and CTLA-4/B7-1/B7-2), made by some types of immune system cells, such as T cells, and some cancer cells. (43 Companies)

Immuno-Oncology Startups Developing – Cellular Immunotherapies.

Developing Chimeric Antigen Receptor (CAR) T-cell therapy, T-cell Receptor (TCR) therapy, Tumor-Infiltrating Lymphocytes (TIL) therapy, Dendritic Cell Vaccine. (98 Companies)

Immuno-Oncology Startups Developing – Oncolytic Viruses based Therapeutics.

Non-pathogenic viral strains which selectively infect and kill malignant cells, while favoring the elicitation of a therapeutically relevant tumor-targeting immune response. (33 Companies)

Immuno-Oncology Startups Developing – Peptide Vaccines.

Stimulating immune response against one or multiple Tumor-Associated Antigens following immunization with purified, recombinant or synthetically engineered epitopes. (27 Companies)

Immuno-Oncology Startups Developing – Bispecific T Cell Engagers.

Bispecific molecules redirecting the cytotoxicity of T-cells Tumor-Associated Antigens following immunization with purified, recombinant or synthetically engineered epitopes. (13 Companies)

ImmunoOncology Startups Developing- Monoclonal Antibodies against Tumor Antigen.

(93 Companies)

Section B : Venture Funding & Big Pharma Partnering – I/O Startups 2020 (Big Pharma Partnering, Deals & Investments in Startups)

Immuno-Oncology Startups – MAJOR DEALS & PARTNERING ACTIVITIES – 2019 (uptill Sep. 2019). (38 I/O Exclusive Deals Details)

Immuno-Oncology Startups – MAJOR DEALS & PARTNERING ACTIVITIES – 2018 (62 I/O Exclusive Deals Details)

Immuno-Oncology Startups – MAJOR DEALS & PARTNERING ACTIVITIES – 2017 (54 I/O Exclusive Deals Details)

Immuno-Oncology Startups Funding – 2019 (uptill Sep. 2019)

Amount Raised; Funding Details – Seed, Series A, Series B, Series C, Grants and Initial Public Offering; Investors Details, etc. (47 I/O Exclusive Funding Details)

ImmunoOncology Startups Funding – 2018

Amount Raised; Funding Details – Seed, Series A, Series B, Series C, Grants and Initial Public Offering; Investors Details, etc. (99 I/O Exclusive Funding Details)

Immuno-Oncology Startups Funding – 2017

Amount Raised; Funding Details – Seed, Series A, Series B, Series C, Grants and Initial Public Offering; Investors Details, etc. (89 I/O Exclusive Funding Details)

Big Pharma Investments / Partnering Deals with Immuno-Oncology Startups.

Top 10 Venture Investors, and their Active Immuno-Oncology Startups Portfolio.

Section C : Individual Immuno-Oncology Startup Profile (with Active Pipeline)

Alphabetical Profiles of Active Immuno-Oncology Startups (Top 400 Companies)

Individual Company Profile Covers: An Overview to Drug Developer, Key technology platform, Venture Funding Rounds, Oncology centered Deals & Partnership, Collaborations and Business Insights.

Immuno-Oncology Drug Pipeline –Drugs name, its targets, with details of its development for various indications for cancer cure.

Management Profile –Address, Contact number, e-mail, Key Management / Decision Maker (CXOs) name and designation, with individual Linked ID and contact emails.

Table A.1 Top 15 Highly Innovative Startups capable of changing future of Immuno-Oncology Drug Discovery & Development.

Table A.2 Immune Checkpoint Modulator focused Drug Developers, established between 2010 to mid of 2019. (43 Companies)

Table A.3 Cellular Immunotherapies developing Immuno-Oncology StartUps, established between 2010 to mid 2019. (98 Companies)

Table A.4 Oncolytic Viruses based Therapies developing Immuno-Oncology StartUps, established between 2010 to mid 2019. (33 Companies)

Table A.5 Peptide Vaccine developing Immuno-Oncology StartUps, established between 2010 to mid 2019. (27 Companies)

Table A.6 Bispecific T Cell Engagers developing Immuno-Oncology StartUps, established between 2010 to mid 2019. (13 Companies)

Table A.7 Monoclonal Antibodies against Tumor Antigens developing Immuno-Oncology StartUps, established between 2010 to mid 2019. (93 Companies)

Table B.1 Immuno-Oncology Startups MAJOR DEALS & PARTNERING ACTIVITIES – 2019. (uptill Sep. 2019)

Table B.2 Immuno-Oncology Startups MAJOR DEALS & PARTNERING ACTIVITIES – 2018.

Table B.3 Immuno-Oncology Startups MAJOR DEALS & PARTNERING ACTIVITIES – 2017.

Table B.4 Immuno-Oncology Startups Funding- 2019. (uptill Aug. 2019)

Table B.5 Immuno-Oncology Startups Funding- 2018.

Table B.6 Immuno-Oncology Startups Funding- 2017.

Table B.7 BIG PHARMA Investment Portfolio & Research Partnering with Immuno-Oncology Drug Development Startups.

Table B.8 Top 10 Venture Investors in Immuno-Oncology Startups & Their Investment Portfolio.

Our Report Buyers

Trusted by Over 150+ Companies

(Since 2012 Onward)