Oncology Startups 2017, is the first unique attempt to provide highly precise and updated information on newly established cancer drug developing companies and enables their early identification.

The Report illuminates Top 500 cancer drug developers established during 2010-2016, and without any doubt is one of the world’s largest focused data coverage on Active Drug Developers working with numerous methodologies to target cancer.

Oncology Startups 2017, is unique in many aspects as it for the first time provides cancer startups ranking, based on individual company’s overall score on five major parameters- venture funding, key management, technology, deals & partnerships and cancer focused pipeline. The report, also provides quick infographics and final intelligence to keep information on fingertips.

“first Innovative Report Helping You to

Early Identify Startups & Partner with Them”

Report’s Key Highlights –

- Startups Focused – Highly focused, includes only startups involved directly in Cancer Drug Discovery & established on and after 2010.

- Worldwide Geographic Coverage – Covers Top 500 startups from 28 countries, developing 628 cancer targeting therapies.

- Top 500 Ranking –For better, quicker and focused actionable intelligence on startups.

- Vast ImmunoOncology Coverage – Special Coverage, Infographics & Intelligence on 225 Top Emerging Immunooncology Startups.

- Technology / Drug Pipeline – Details on Individual Startup’s proprietary Technologies with its Active Cancer Pipeline and University / Institutes Collaborations.

- Strategic Moves & Advantages– Quickly Identify the key strategic moves a startup is taking to be more innovative, also identify its strategic advantages, that will boost its growth going forward.

- Venture Funding /Partnering – Monitor Individual Startup’s Various Funding Rounds (Private / Govt. ). Its current Partnering Status with CROs / Research Institutes / Big Pharma.

- Key Management Contacts – Big Time Saver – Key Management Details / Contacts / e-mails / LinkedIn … all at one place

Finally, the report is based on selecting Top 500 Active Oncology Drug Developers, selected from over 700+ companies established during the duration. Also, report covers only active cancer targeting (treatment) companies excluding Merged, Dormant or Simply Idea based companies. The report does not includes cancer diagnostic and cancer pain management companies.

Oncology Startups 2017, will help various organizations working on cancer research, to supercharge with lots of new decision making information and jumpstart their current partnering/marketing efforts.

Table of Content:-

- List of Top 500 Oncology Startup (Drug Developer) Companies.

SECTION A :- Oncology Startups 2017 – Top 500 Active Drug Developers’ Summary – INFOGRAPHICS & INTELLIGENCE

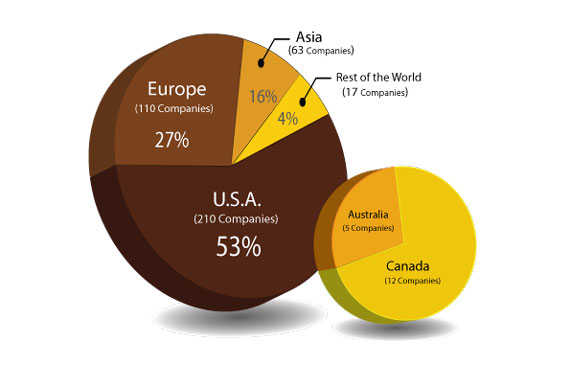

- Infographics – Quantitative Estimation of Oncology Startups present in U.S.A vs. Europe vs. Asia vs. Canada vs. Rest of the World (established between Jan 2010 to Sep 2016).

- Infographics – Distribution of Top 500 Oncology Startups, on the basis of Year of Establishment.

To explore the emergence of Cancer Drug Discovery and Development.

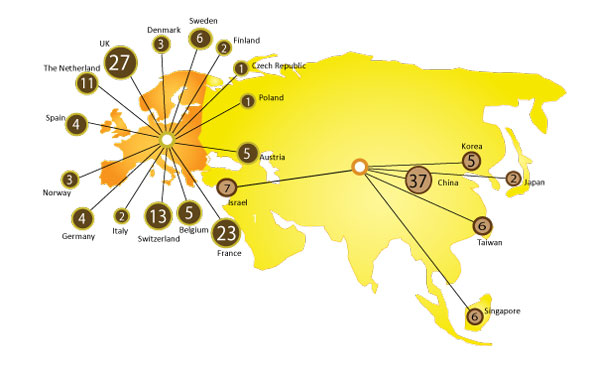

- Infographics – Country-wise Distribution of Oncology Startups having Active Cancer Drug Development Program in Europe and Asia Region.

To identify best and emerging countries, for promoting cancer startups.

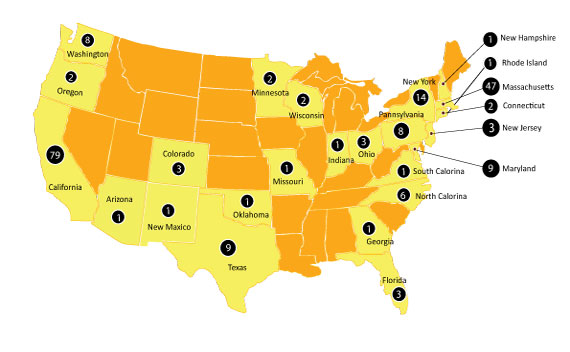

- Infographics – State-wise Distribution of Oncology Startups having Active Cancer Drug Development Program in U.S.A.

To explore the Top cancer startups supporting States in United States.

- Infographics – Division of Top 500 Startups – ImmunoOncology Startup Companies vs. Kinases Targeting vs. others.

To quantitatively explore the emerging areas of interest among startups.

- Infographics – Year wise and Region wise Distribution of Immuno-Oncology Startups.

To explore emerging Immuno-Oncology Supporting Region.

- Intelligence – Rank wise List of Top 500 Oncology Startups.

Key Paramaters for Rank Score – Technology, Funding, Deals, Management & Pipeline.

- Intelligence – Top 25 Innovative Game Changer Oncology Startups.

Capable of changing tomorrow’s Cancer Drug Discovery & Development.

- Intelligence – ImmunoOncology Focused Startups (225 Companies).

- Intelligence – Cancer Vaccine Focused Startups (49 Companies).

- Intelligence – Antibody Drug Conjugate Focused Startups (23 Companies).

- Intelligence – Oncolytic Virus & Gene Therapy Focused Startups (21 Companies).

- Intelligence – Stem Cells, CART & other Cell based Therapy Focused Startups (37 Companies).

SECTION B :- Oncology Startups 2017 – Venture Funding & Big Pharma Partnering & Deals with Startups – INFOGRAPHICS & INTELLIGENCE

- Infographics – Venture Funding in Oncology Startups.

Qualitative Estimate of Funding in Series A vs. Series B/C/D in last three years 2016, 2015 & 2014 in Startups.

- Intelligence – Oncology Startups SERIES A Venture Funding-2016 (uptill Sep.) (31 startups).

- Intelligence -Oncology Startups SERIES B/C Venture Funding-2016 (uptill Sep.) (17 startups).

- Intelligence – Oncology Startups SERIES A Venture Funding – 2015 (38 startups).

- Intelligence – Oncology Startups SERIES B/C/D Venture Funding – 2015 (13 startups).

- Intelligence – Oncology Startups SERIES A Venture Funding – 2014 (20 startups).

- Intelligence – Oncology Startups SERIES B/C Venture Funding- 2014 (8 startups).

- Intelligence – Key Venture Captial Investors in Oncology Startups and their Investment Portfolio.

Big Pharma Partnering, Deals & Investments in Startups:-

- Intelligence – Celgene Corporation – Strategic Deals & Investments in Oncology Startups.

- Intelligence – Janssen Biotech – Strategic Deals & Investments in Oncology Startups.

Investments through Johnson & Johnson Innovation – JJDC, Inc., also included.

- Intelligence – Roche & Genentech – Strategic Deals & Investments in Oncology Startups.

Investments through Roche Ventures also included.

- Intelligence – Novartis – Strategic Deals & Investments in Oncology Startups.

Investments through Novartis Ventures & Novartis Institute of Biomedical Research also included.

- Intelligence – Pfizer – Strategic Deals & Investments in Oncology Startups.

Investments through Pfizer Ventures also included.

- Intelligence – Sanofi – Strategic Deals & Investments in Oncology Startups.

Investments through Sanofi-Genzyme Bio-ventures also included.

- Intelligence – AstraZeneca – Strategic Deals & Investments in Oncology Startups.

Investments through MedImmune Ventures also included.

- Intelligence – Lilly – Strategic Deals & Investments in Oncology Startups.

Investments through Lilly Ventures & Lilly Asia Ventures also included.

- Intelligence – Bristol Myers Squib – Strategic Deals & Investments in Oncology Startups.

- Intelligence – Astellas – Strategic Deals & Investments in Oncology Startups.

Investments through Astellas Ventures also included.

- Intelligence – Merck & Company- Strategic Deals & Investments in Oncology Startups.

- Intelligence – Amgen – Strategic Deals & Investments in Oncology Startups.

Investments through Amgen Ventures also included.

SECTION C :- Oncology Startups 2017 – Top 500 Companies Profiles.

A to Z Alphabetical Profiles of Active Oncology Startup Companies (500 Companies) founded between

Individual company Pages includes: Company Profile, Company Rank, Key technology platform, Venture Funding Rounds, Oncology centred Deals & Partnership, Collaborations and Business Insights.

Oncology Drug Pipeline –Drugs name, its targets, with details of its development for various indications for cancer cure, FDA/EMEA Orphan drug status.

Management Profile –Address, Contact number, e-mail, Key Management / Decision Maker (CXOs) name and designation, with individual Linked ID and contact emails.

Appendix A: Country Wise List of Top 500 Oncology Startup Companies.

Appendix B: Complete 628 Molecules List, along with their Developer’s Name.

Table A.1 Top 500 Active Oncology (Drug Developer) Startups – Ranking

(based on Oncology Focused Technology, Funding, Deals, Pipeline and Key Management).

Table A.2 Top 30 Highly Innovative Startups capable of changing future of Oncology Drug Discovery &

Development.

Table A.3 Immuno-Oncology Focused StartUps, established between 2010 to mid 2016 (225 Companies).

Table A.4 Cancer Vaccine focused Oncology StartUps, established between 2010 to mid 2016 (49 Companies).

Table A.5 Antibody Drug Conjugate StartUps, established between 2010 to mid 2016 (23 Companies).

Table A.6 Oncolytic Virus & Gene Therapy StartUps, established between 2010 to mid 2016 (23 Companies).

Table A.7 Stem Cell, CART & other Cell based Therapy focused Startups (37 Companies).

Table B.1 Oncology Startups Venture Funding – 2016 (uptill Sep), Series A funding round.

Table B.2 Oncology Startups Venture Funding – 2016 (uptill Sep), Series B&C funding round.

Table B.3 Oncology Startups Venture Funding – 2015, Series A funding round.

Table B.4 Oncology Startups Venture Funding – 2015, Series B/C/D funding round.

Table B.5 Oncology Startups Venture Funding – 2014, Series A funding round.

Table B.6 Oncology Startups Venture Funding – 2014, Series B/C/D funding round.

Table B.7 Top 10 Venture Investors in Oncology Startups & Their Investment Portfolio.

Table B.8 Celgene Corporation Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.9 Celgene Corporation Investment Portfolio in Oncology Drug Development Startups.

Table B.10 Janssen Biotech Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.11 Janssen Biotech Investment Portfolio in Oncology Drug Development Startups.

Table B.12 Roche & Genentech Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.13 Roche & Genentech Investment Portfolio in Oncology Drug Development Startups.

Table B.14 Novartis Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.15 Novartis Venture Fund Investments in Oncology Drug Development Startups.

Table B.16 Novartis Institute of Biomedical Research Investments in Oncology Startups.

Table B.17 Pfizer Inc. Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.18 Pfizer Investments in Oncology Drug Development Startups.

Table B.19 Sanofi SA Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.20 Sanofi – Genzyme Bioventures Investment in Oncology Drug Development Startups.

Table B.21 Astrazeneca Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.22 Astrazeneca Investments in Oncology Drug Development Startups.

Table B.23 Lilly Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.24 Lilly Ventures Investments in Oncology Drug Development Startups.

Table B.25 Lilly Asia Ventures Investments in Oncology Drug Development Startups.

Table B.26 Bristol-Myers Squibb Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.27 Astellas Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.28 Astellas Ventures Investments in Oncology Drug Development Startups.

Table B.29 Merck & Company Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.30 Amgen, Inc. Strategic Oncology Drug Development Deals with Oncology Startups.

Table B.31 Amgen Ventures Investments in Oncology Drug Development Startups.

Figure A.1 Qualitative Estimation of Top 500 Active Oncology Startups, established between 2010-2016; present in U.S.A vs. Europe vs. Asia vs. Rest of the World.

Figure A.2 Bar Graph for year specific establishment of Top 500 Active Oncology Startups; during 2010 to mid 2016.

Figure A.3 Individual Country specific Distribution of Oncology Startups (Drug Developer) in EuroAsia Region – Europe (14 Countries) and in Asia (6 Countries).

Figure A.4 U.S State specific Distribution of Oncology Startups in U.S.A. (established from 2010 to mid 2016).

Figure A.5 Division of Top 500 Oncology Drug Development Startups – Immuno-Oncology Startups vs. Kinases Targeting vs. Others.

Figure A.6 Year specific and Region specific Distribution of ImmunoOncology Startups.

Figure B.1 Total Venture Funding in Oncology Startups in 2014, 2015, 2016 (till Sep) in various A / B / C / D series of funding rounds.

Figure B.2 Country specific companies securing venture funding in various A/B/C/D series of rounds, in 2016 (till Sep), 2015, & 2014.