Global Rise of Drug Developers: Welcome to the Age of Bio-Innovators

In recent years, the landscape of drug development has undergone a remarkable transformation. This shift, driven by groundbreaking advancements in biotechnology, data science, and a collaborative global effort, has ushered in what many are calling the Age of Bio-Innovators. This era is marked by a surge in innovative drug development practices, promising new therapies, and an unprecedented pace of medical breakthroughs. Let’s delve into the factors driving this global rise and explore what the future holds for bio-innovation.

The Bio Innovations Boom

The biotechnology sector has experienced exponential growth, fueled by advances in genetic engineering, cell therapy, and regenerative medicine. Technologies such as CRISPR-Cas9, which allows for precise gene editing, and CAR-T cell therapy, a revolutionary approach to cancer treatment, are just a few examples of how biotech is reshaping the drug development landscape.

Data-Driven Drug Development

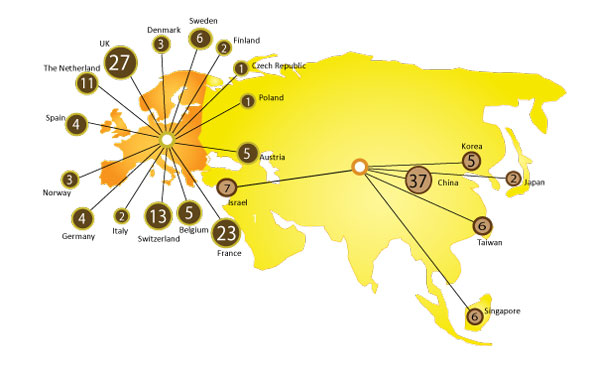

Global Collaboration

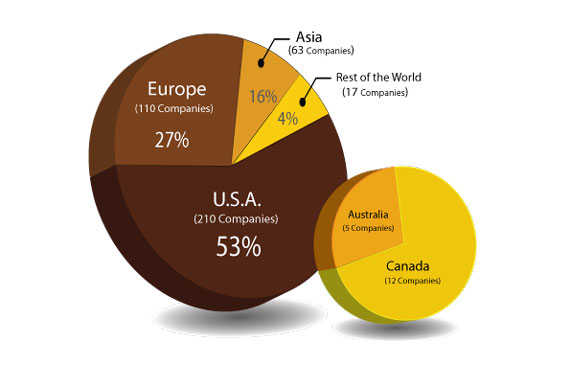

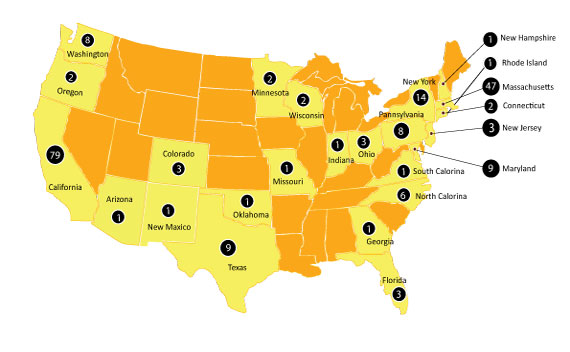

Startups and Bio-Innovators

A new wave of startups and bio-innovators is driving much of this progress. These agile, research-focused companies are often at the forefront of developing novel therapies. Their ability to quickly pivot and innovate makes them key players in the drug development ecosystem. Venture capital and public funding are increasingly flowing into these startups, providing the financial backing needed to turn promising research into viable treatments.

Personalized Medicine

One of the most exciting developments in this new age of bio-innovation is the shift toward personalized medicine. Advances in genomics and molecular biology allow for treatments tailored to individual patients’ genetic profiles. This approach not only increases the efficacy of therapies but also minimizes adverse effects, leading to better patient outcomes.

Regulatory Evolution

Regulatory agencies worldwide are evolving to keep pace with the rapid advancements in drug development. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are adopting more flexible frameworks to expedite the approval of breakthrough therapies. Initiatives like the FDA’s Breakthrough Therapy Designation and the EMA’s PRIME scheme aim to accelerate the development and review of drugs that address unmet medical needs.

The Future of Drug Development

Conclusion

The global rise of drug developers marks an exciting chapter in medical history. The Age of Bio-Innovators is not just about technological advancements; it’s about improving human health on a global scale. By harnessing the power of biotechnology, data science, and international collaboration, we are poised to conquer some of the most formidable health challenges of our time. Welcome to the Age of Bio-Innovators—where the future of medicine is being written today.